Regulatory Radar: Surmodics Navigates Choppy FTC Waters in Minnesota Showdown

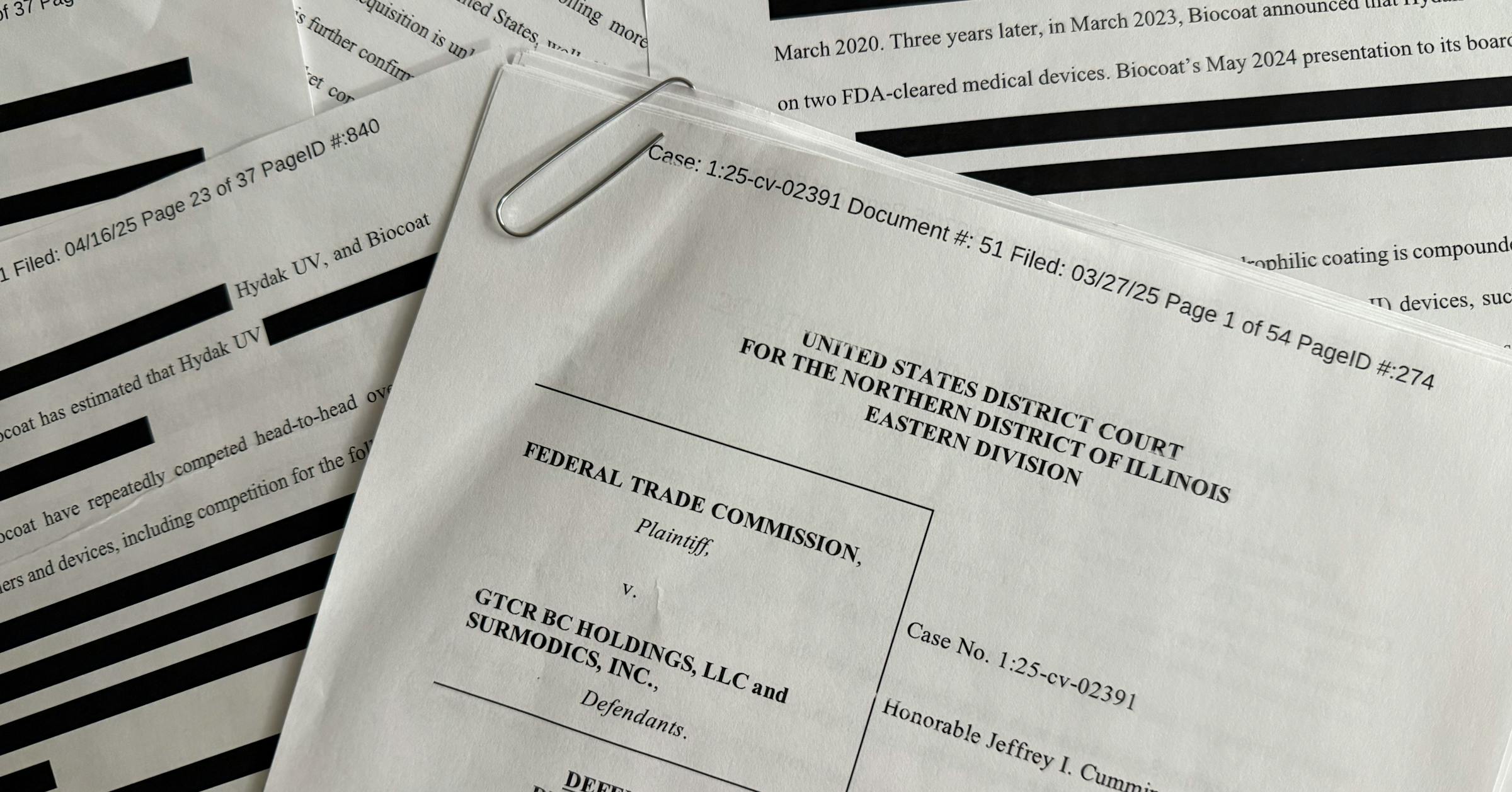

The legal landscape of private equity is set to face intense scrutiny as a landmark case emerges in the wake of heightened regulatory attention during the Biden administration. This closely watched legal battle highlights the growing focus on corporate actions within the private equity sector, signaling a potential shift in how such transactions are examined and regulated.

During the previous administration, the Federal Trade Commission (FTC) increasingly turned its investigative lens toward private equity-related corporate maneuvers, creating a more challenging environment for investment firms. Now, this upcoming case promises to test the boundaries of regulatory oversight and potentially set new precedents for how private equity transactions are evaluated.

The case represents a critical moment for both regulators and private equity firms, as it could reshape the understanding of corporate governance, market competition, and the complex interactions between investment strategies and regulatory frameworks.