Money Drains: 5 Everyday Habits Silently Sabotaging Your Financial Health

The Illusion of Financial Success: When Luxury Meets Reality

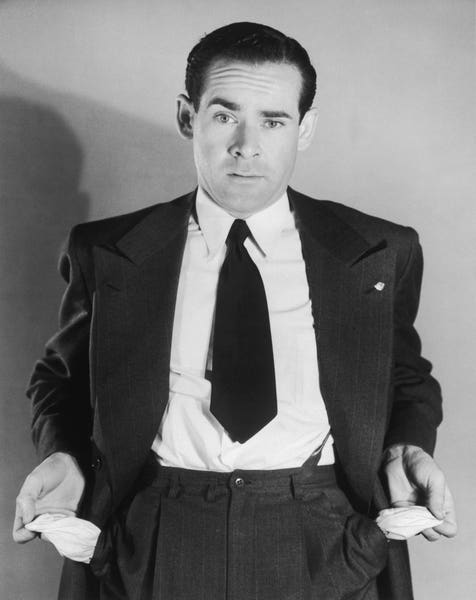

We've all been there—standing in front of a gleaming display case, eyeing that perfect luxury watch, imagining ourselves as successful, sophisticated individuals. The temptation is real: a stunning timepiece that promises to reflect our aspirations and potential. Yet, beneath the surface of these grand dreams lies a stark contrast—a financial reality that often falls short of the polished image we're trying to project.

Many of us have experienced this disconnect: purchasing symbols of success while our actual financial foundation remains fragile. It's a modern paradox where appearances can be deceivingly aspirational. That expensive watch becomes more than an accessory; it's a statement of hope, a tangible representation of the life we wish we had.

But true financial wellness isn't about surface-level displays of wealth. It's about building genuine stability, making smart choices, and understanding the difference between momentary gratification and long-term financial health. The most successful individuals know that real prosperity is built quietly, consistently, and often without flashy accessories.

So before you make that next big purchase, pause and ask yourself: Am I investing in my future, or just buying an illusion?