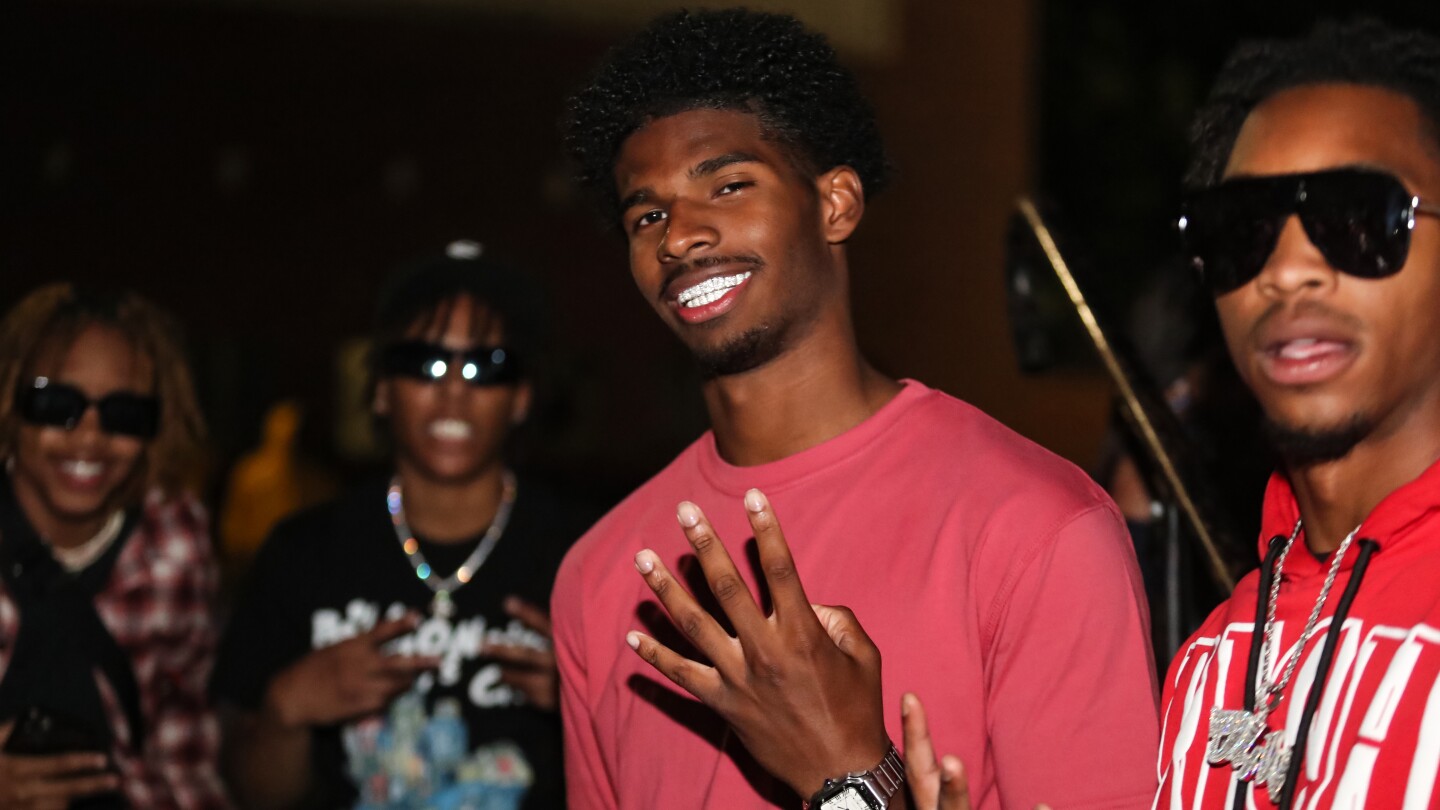

Draft Day Drama: Shedeur Sanders' Potential Round 4 Landing Spots Revealed

The economic rollercoaster that investors have been riding might be approaching its final descent. After months of market volatility and uncertainty, signs are emerging that suggest the current market slide could be nearing its conclusion.

Recent economic indicators point to potential stabilization, with key market sectors showing resilience despite ongoing challenges. Investors who have been cautiously watching from the sidelines may soon find opportunities emerging in what has been a turbulent financial landscape.

Experts are noting subtle shifts in market dynamics that hint at a possible turning point. While complete recovery is not guaranteed, the current trends suggest we might be witnessing the early stages of a market correction that could pave the way for renewed growth.

For savvy investors, this moment represents a critical juncture. Those who can read the market's nuanced signals and make strategic decisions could position themselves to capitalize on potential upcoming opportunities. The key will be maintaining a balanced perspective and avoiding knee-jerk reactions to short-term fluctuations.

As always, diversification and careful analysis remain crucial strategies in navigating these uncertain financial waters. The slide might be ending, but smart investment approaches will continue to be the compass guiding investors through changing economic terrains.