Betting Bonanza Bust: How NC's New Tax Could Shrink Your Gambling Winnings

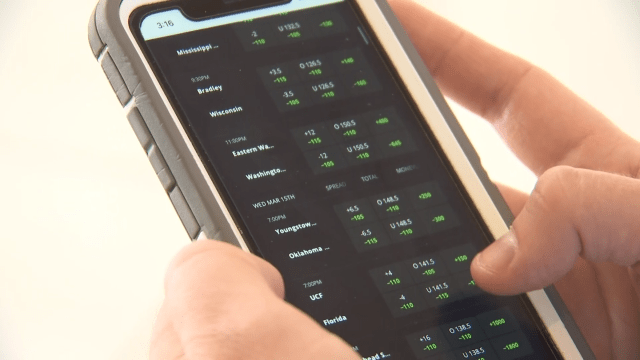

Sports betting enthusiasts in North Carolina are facing a potential game-changer this week. If you've recently logged into your favorite online betting platform, you've likely encountered an urgent alert about a proposed tax increase that could significantly impact the gambling landscape in the state.

The North Carolina Senate is currently considering a tax hike that has caught the attention of bettors across the region. This proposed legislation has sparked widespread discussion and concern among those who enjoy placing wagers on their favorite sports teams and events.

Online sportsbooks are taking proactive steps to inform their users about the potential changes, urging them to stay informed and potentially voice their opinions to local representatives. The proposed tax increase could have far-reaching implications for both casual bettors and the sports gambling industry as a whole.

As the situation develops, sports betting fans are closely watching the potential legislative changes that could reshape the betting experience in North Carolina. Stay tuned for updates on this evolving story that could impact your online sports betting activities.