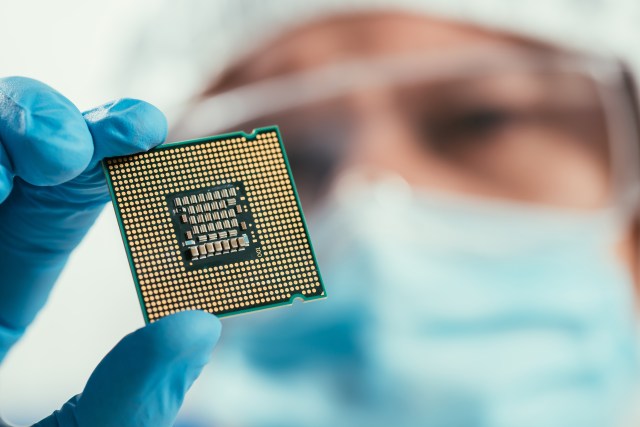

Silicon Shortage: Will America's CHIPS Act Crumble Without Skilled Talent?

The semiconductor industry faces significant challenges in scaling up domestic chip manufacturing. Critical obstacles include a shrinking talent pool and prohibitively expensive local production costs that make investment in domestic chip capacity increasingly difficult. These structural economic barriers are creating substantial roadblocks for companies seeking to establish robust domestic semiconductor production capabilities. The current landscape reveals that building a competitive domestic chip manufacturing ecosystem requires more than just financial investment. It demands a strategic approach to workforce development and a comprehensive reevaluation of cost structures that can make local production economically viable. Without addressing these fundamental issues, the United States risks falling further behind in the critical semiconductor supply chain.